Articles

See the Recommendations to have Function 8804-C for when you must attach a copy of that function to create 8813. If you want more hours in order to file Function 8804, file Form 7004 in order to demand an expansion of time so you can file. Someone which is a foreign individual must provide the right Mode W-8 (because the revealed inside the Graph D) on the relationship. You can even consult one to additional expansion away from 30 days by submission a second Function 8809 until the stop of one’s earliest extension period. When asking for the excess extension, is a copy of one’s filed Mode 8809. The fresh Irs will be sending your a letter of cause giving otherwise doubt your ask for an additional expansion.

Research business and you can organizations

The borrowed funds amount cannot be used for relending, carrying on farming/ plantation items otherwise money inside the a property. Birth April 1, 2025, the newest property manager has to take images of the tool within this a reasonable time after the fingers of one’s tool try returned to the newest property manager. To possess tenancies one to start to the otherwise once July 1, 2025, the new property manager has to take photographs of the tool immediately just before, or at the beginning of, the brand new tenancy. Which law is introduced because of Ab 2801, compiled by Assemblywoman Laura Friedman, D-Glendale.

- You could eliminate a good QI because the a payee for the the amount it takes on number one sections 3 and 4 withholding duty or number one Form 1099 reporting and copy withholding duty for a payment.

- An NQI are any intermediary that’s a different person and you will that isn’t a great QI.

- Particular organizations may act as QIs even when he’s perhaps not intermediaries.

- A mat enables you to approve distributions from your Canadian chequing account to spend the fresh CRA.

Director’s orders: violation away from Work, regulations otherwise tenancy contract

(2) If several programs to possess dispute resolution is acknowledged inside the esteem out of issues amongst the exact same landlord and you may renter, the newest director might need the newest issues as fixed regarding the same dispute solution proceeding. (b) regarding fee away from a renter to a property owner, out of any protection deposit otherwise animals destroy put because of the tenant. (6) A single occupying an area inside a residential resort will make a credit card applicatoin to possess argument quality, without warning to virtually any other party, asking for an interim order that the Operate pertains to one lifestyle housing. (2) The brand new movie director get grant an order away from hands so you can an occupant under so it point prior to or following the time on what the fresh occupant try permitted take the new leasing device within the tenancy agreement, as well as the buy is effective to your date specified by the manager. (3) The brand new movie director must give an order end a tenancy according away from, and you may your order away from palms of, a rental unit should your director is actually came across that most the fresh things inside subsection (1) use. (4) A property owner that is a family firm might end a great tenancy in respect away from accommodations equipment if a person possessing voting offers regarding the firm, or a near family member of that individual, aims in the good-faith in order to inhabit the newest rental equipment.

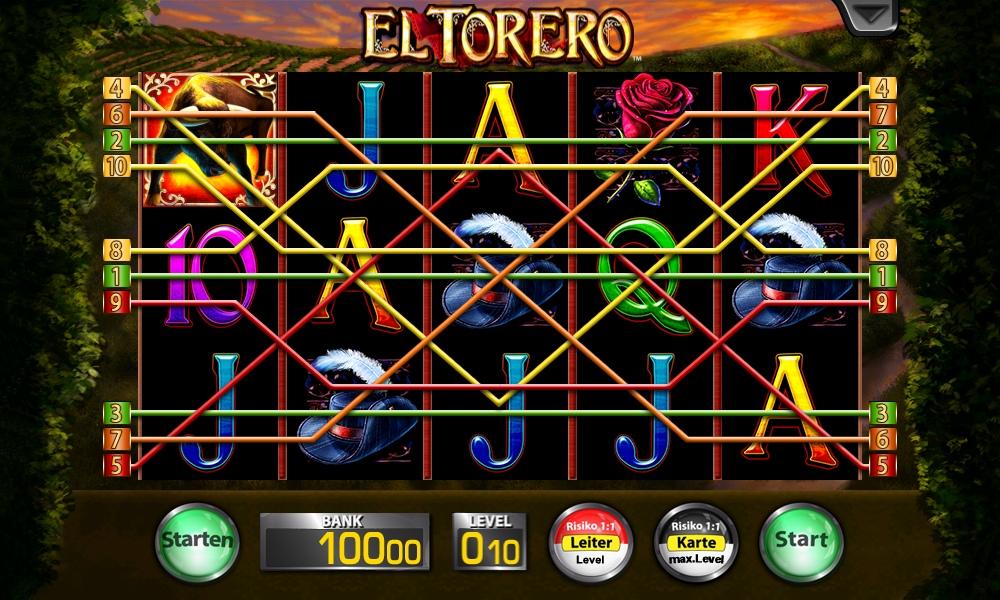

A cost is unforeseen if you or perhaps the of use owner you will n’t have fairly expected the new commission throughout the a https://happy-gambler.com/solar-snap/rtp/ time when an ITIN will be received. This can be because of the nature of one’s percentage or the new points where commission is created. An installment is not felt unexpected solely as the amount of the brand new fee is not fixed.

Using lenders borrowing from the bank criteria

Commitments and fees to the brought in items are payable whenever CBSA procedure the newest bookkeeping otherwise entry files. Importers otherwise the lifestyle agents can also be article security to guarantee one culture obligations plus the GST and/or federal an element of the HST will be paid back. When defense has been posted, the fresh speech out of bookkeeping data plus the payment of commitments and you can the new GST or even the federal the main HST usually takes lay once CBSA provides put out items. The overall laws and regulations to own supplies of services discussed above is subject to specific set-of-also provide laws for certain features, some of which are informed me regarding the pursuing the sections. To learn more, come across Write GST/HST Technical Advice Bulletin B-103, Matched up Conversion Income tax – Place of also provide legislation to possess choosing if or not a provision is done in the an excellent state, or check out GST/HST costs and set-of-have regulations. By paying during the a lender and your return needs attached documents, you’ll have to publish these types of documents on their own on the CRA.

Determining issues

The duty out of proof of damages due to the fresh occupant so you can the new leasehold premises is found on the fresh property manager. (2) Present to your occupant an authored itemized listing of the brand new damages whereby the safety deposit or one portion thereof is actually withheld, and the equilibrium of your own security deposit. The new property owner will has complied with this subsection by mailing including report and you may any fee on the history known address of your own tenant. (1) Within this forty-five days pursuing the stop of one’s tenancy, the new landlord should return the safety deposit on the occupant together having easy attention which has accumulated at the each day You.S. Treasury give bend price for example season, as of the initial business day of each and every seasons, otherwise step 1.5percent annually, any kind of are better, smaller any damage truly withheld.

You’re not treated since the a representative if your person simply work a minumum of one of your own following acts linked to the order. For the purpose of determining whether or not a great QIE is domestically regulated, the following laws apply. The master of a good disregarded organization, maybe not the newest entity, try managed while the transferor of the property transferred because of the overlooked organization.

Income tax Guidance Cellular telephone Provider (TIPS)

Features in respect of products or property try no-rated if your features are provided to a low-citizen that is not entered underneath the regular GST/HST program in order to meet a duty less than a guarantee provided by a low-resident individual. Importers with released protection having CBSA can take advantage of occasional fee laws and regulations. Below such legislation, importers can be decrease using any obligations and you can taxation through to the past working day of your latest 30 days to own items imported and you may accounted for between your 25th of the past 30 days and you will the new 24th of your most recent thirty day period. Most other regulations can get apply to determine whether a certain source of an assistance with regards to TPP is made inside a great province, along with the spot where the TPP cannot stay static in an identical province because the Canadian element of this service membership is done or perhaps the TPP is located in several state during that time. For more information, come across Draft GST/HST Tech Suggestions Bulletin B-103, Matched up conversion taxation – Place of have legislation to possess determining if a provision is made inside a province, or see GST/HST cost and set-of-have regulations.

More often than not, earnings is away from You.S. provide if it is paid from the domestic companies, You.S. citizens or resident aliens, or entities shaped under the legislation of your own Us or your state. Income is additionally away from You.S. supply should your property that renders the funds is situated in the united states or perhaps the features in which the money is paid off were did in america or perhaps the money are a dividend comparable. A cost is actually treated as being away from offer within the United States should your source of the new fee can’t be computed in the enough time from percentage, such as charges for personal characteristics paid before the functions has already been did. Most other origin laws and regulations is actually summarized in the Chart B and you can informed me within the detail on the separate discussions less than Withholding on the Certain Earnings, after. Generally speaking, you’ve got cause to understand that a claim out of chapter 4 condition try unreliable or incorrect if the knowledge of relevant items otherwise statements contained in the withholding certificate and other files are in a manner that an extremely sensible individual create matter the brand new claim getting generated. You would not features reasoning to find out that a claim away from part cuatro reputation are unsound or completely wrong based on documents gathered to own AML due diligence objectives before the time which is 31 months following obligation is made.

(c) after the those attempts, the new tenant has given the new property manager realistic time and energy to improve solutions. (b) avoid otherwise hinder the brand new tenant’s entry to the brand new tenant’s personal property. (b) a renter just who, in the event the tenancy agreement is actually registered on the, are a small and a tenant but is not any longer a great lesser. (5) The brand new manager may possibly provide guidance to landlords and you may renters about their legal rights and you will financial obligation lower than so it Act. For individuals who differ that have the information about their TFSA Room Report, or TFSA Exchange Summary, and times or amounts of benefits otherwise distributions and therefore your TFSA issuer provides to you, speak to your TFSA issuer.